India's four new labour codes became effective on November 21, 2025, consolidating 29 fragmented laws into a unified framework. For CHROs and compensation leaders, this represents the most significant structural change to workforce management in decades.

The implications run deep. Your existing salary structures likely don't comply with the new 50% wage definition. Benefits calculations for PF and gratuity need recalibration. Fixed-term employees now qualify for benefits after one year instead of five.

These are fundamental shifts in how compensation works in India. Organizations that treat this as routine compliance risk, financial exposure, and employee relations challenges down the line.

The goal of this guide is to help HR and compensation professionals understand and implement India's new labour codes to ensure compliance while optimizing their compensation structures for both immediate needs and long-term workforce planning.

What's Changed – Highlights That Matter to CHROs and CROs

At a Glance

Uniform Definition of Wages

Your salary structures need immediate attention.

The new code mandates that basic pay must form at least 50% of total remuneration – no exceptions. If your organization has been keeping basic pay at 30-40% of CTC (a common practice to minimize PF contributions), you're now non-compliant.

- This affects everything tied to "wages." Your PF contributions will increase since they're calculated on a higher base.

- Gratuity liabilities could jump 25-50% according to industry estimates.

- Bonus calculations, leave encashment, and overtime pay all need to be recalculated.

The days of structuring compensation with numerous allowances to reduce statutory obligations are over.

Universal Social Security

Social security isn't just for traditional employees anymore. Gig workers, platform workers, and contract staff now fall under the umbrella of protection. If you engage aggregators or platform workers, expect to contribute 1-2% of your annual turnover (capped at 5% of the amounts paid to these workers) to their social security fund.

This pushes workforce formalization into overdrive. Organizations relying heavily on gig models need to budget for these new contributions and rethink their engagement strategies.

Formalization of Employment

Every worker needs an appointment letter – no exceptions, no sectors exempt. This seemingly simple requirement carries weight. It means documented terms, precise role definitions, and traceable employment relationships for everyone from your senior managers to contract staff.

For organizations with informal hiring practices or verbal agreements, this demands a process overhaul. You'll need standardized templates, approval workflows, and systems to track and store these documents.

Mandatory Minimum Wages and Timely Pay

Minimum wages now apply universally. The central government sets a floor wage based on living costs, and states cannot set a salary below it. Every employee in every sector must receive at least the statutory minimum – including roles traditionally exempt.

Payment delays are now legally punishable. If your payroll processes occasionally slip or your vendor payments lag, you face legal consequences. Organizations operating across multiple states must track varying state minimums while ensuring none fall below the national floor.

Women's Workforce Empowerment

Equal pay becomes legally mandatory, with enforcement mechanisms. Women can work night shifts and in all roles previously restricted, provided safety protocols are in place. This opens talent pools but requires infrastructure investment.

- Review your compensation data for pay gaps.

- Update safety policies, transport arrangements, and workplace facilities.

Organizations already practicing pay equity gain a competitive advantage in attracting talent. Those with gaps face both compliance risk and talent retention challenges.

Simplified Compliance Architecture

One registration, one license, one return – that's the promise. The consolidated approach replaces multiple registrations across different laws. For organizations struggling with compliance complexity, this streamlining offers relief.

However, simplified doesn't mean simple. You need integrated systems to manage this unified compliance. Manual processes won't scale. Investment in HRMS and compliance platforms becomes essential rather than optional. Organizations with robust systems can reduce compliance overhead, while those relying on spreadsheets will struggle with the transition.

Strategic Implications for CHROs and Compensation Leaders

The new labour codes demand immediate strategic recalibration. Your organization's current compensation philosophy, built over years of regulatory workarounds, needs fundamental rethinking.

Salary Restructuring Is Non-Negotiable

- Most Indian organizations maintain basic pay below 40% of CTC - this structure is now non-compliant

- You must either restructure to meet the 50% threshold or calculate benefits on a notional 50% base (creates compliance complexity)

- Smart move: Redesign packages by converting special allowances into basic pay

- Priority: Start with junior roles where the basic-CTC gap is typically largest

- Timeline: Model every employee's package now to identify gaps and create transition plans

Recalibrating Financial Obligations

- PF contributions increase on both sides - ₹20,000 to ₹25,000 basic means ₹600 extra monthly per employee

- Gratuity liabilities jumping 25-50% across organizations - your last actuarial valuation is already outdated

- Immediate needs: Top-up gratuity funds, recalculate bonus pools, update leave encashment reserves

- Fixed-term employees are now eligible for gratuity after one year (previously five years)

- Every benefit calculation tied to "wages" needs fresh math

Managing Budget Trade-offs

Three scenarios facing every CHRO:

- Option 1: Hold CTC constant, let take-home drop - controls costs but impacts employee morale

- Option 2: Increase CTC to maintain take-home - preserves satisfaction, but costs surge

- Option 3: Partial adjustments with strong communication about long-term benefits (most common choice)

Key consideration: Employees with EMIs won't appreciate reduced take-home, regardless of retirement corpus growth

Rethinking Employment Models

- Fixed-term contracts lose appeal - gratuity after one year eliminates cost advantage

- Contract labour prohibited for "core activities" - define this carefully for your business

- Gig workers need social security contributions (1-2% of aggregator turnover)

- Contractor arrangements may now cost more than permanent employees

- Workforce mix economics need a complete recalculation based on new obligations

“The real significance of the Labour Codes goes beyond regulation. They mark a cultural inflection point — one that challenges us to shape a more diverse, equitable, and inclusive world of work in India.” - Navneet Rattan, Partner & COO and Global Head - Product Development at Compport

The CRO View – Risk, Governance, and Transition Clarity

Chief Risk Officers face a multi-layered compliance challenge. The labour codes are an enterprise risk that demands board-level attention.

Compliance Risk: The Ticking Time Bomb

- Wage misclassification is your biggest exposure – incorrect calculations trigger penalties plus backdated liabilities

- Every employee below 50% basic pay represents potential non-compliance dating back to November 21, 2025

- Audit trails matter: regulators will examine your interpretation of "wages" versus "allowances"

- Historical structures with creative allowances now create documentary headaches

- Penalties apply per violation, per employee – large workforces mean multiplied risk

Policy Divergence Risk: Operating in Limbo

- Central codes are live, but state rules are still pending – you're building on shifting ground

- Each state will interpret and implement differently, creating a patchwork compliance landscape

- Organizations need dual frameworks: one for current requirements, another ready for state notifications

- Inter-state transfers and multi-location operations face compounded complexity

- Documentation must capture which rules applied when – version control becomes critical

Operational Risk: Systems and Silos

- Legacy payroll systems weren't built for these calculations – manual workarounds invite errors

- HR knows the rules, Finance owns budgets, Legal interprets grey areas – but who owns integration?

- Outdated HRIS configurations will calculate wrong PF, wrong gratuity, and wrong overtime

- Vendor and contractor management systems need updates to track new employment categories

- One misconfigured formula affects thousands of paychecks monthly

Building a Controlled Transition Plan

Essential components for risk mitigation:

- Scenario modeling: Run three versions minimum (conservative, moderate, aggressive interpretations)

- Policy versioning: Document what changed, when, and why – create clear audit trails

- Phased rollouts: Test with smaller groups before company-wide implementation

- Cross-functional task force: Weekly meetings between HR, Finance, Legal, and IT until stable

- Training cascade: Leadership first, then HR teams, then managers, and finally all employees

- Contingency reserves: Budget for calculation errors, system fixes, and potential penalties

- External validation: Engage auditors early to verify interpretation and implementation

The governance framework must answer:

- Who approves structural changes?

- How do we track compliance?

- What triggers escalation?

Without clarity, you're managing blind.

Technology should be the Bridge Between Compliance Chaos and Strategic Control

Manual processes can't handle the labour code transition. Calculating new wage structures for thousands of employees, tracking state-specific rules, and maintaining audit trails in spreadsheets invites disaster.

The Core Challenge

The 50% wage rule requires recalculating every employee's package individually. Add multiple state minimum wages, varying PF calculations, and gratuity projections – spreadsheet formulas break down. One error cascades through hundreds of calculations. Version control becomes impossible when multiple teams update different files.

Where Technology Steps In

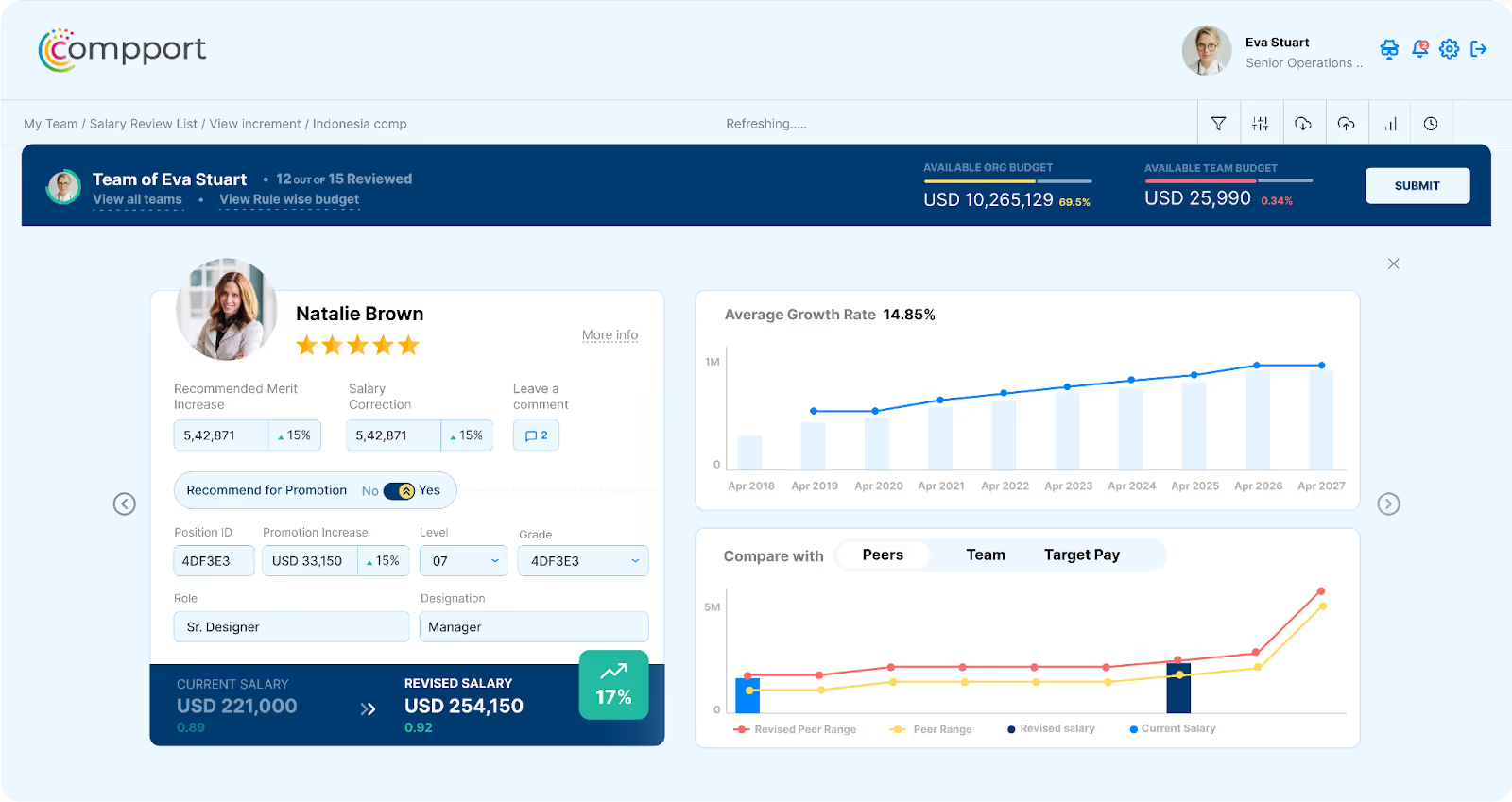

Compensation platforms like Compport transform weeks of manual calculation into instant analysis.

- Set the 50% threshold once, and every non-compliant package gets flagged with exact adjustment requirements.

- State minimum wages update automatically – no manual tracking needed.

The real value comes in simulation capabilities.

- Model three restructuring scenarios simultaneously to see PF outflow changes, gratuity liability impacts, and budget implications before implementation.

- Generate personalized employee letters explaining why take-home decreased while long-term benefits increased – with actual numbers, not generic templates.

- Live dashboards maintain ongoing compliance instead of periodic checks. When calculation methods change, audit trails document what was applied at each step.

The investment prevents a single penalty or calculation error from affecting hundreds of employees. More importantly, it frees HR from manual calculations to focus on strategic compensation decisions.

From Compliance Burden to Competitive Advantage

The labour codes aren't just another regulatory hurdle. As a CHRO, you should see the opportunity – simplified salary structures, enhanced employee benefits, and transparent compensation that builds trust.

While competitors struggle with spreadsheets and confused employees, forward-thinking organizations are already ahead. They've modeled scenarios, communicated changes clearly, and turned forced restructuring into strategic compensation design. Employees understand their pay without having to decode complex allowances. The enhanced PF becomes a retention tool rather than just a compliance cost.

The difference? Technology and timing.

Companies using total compensation platforms like Compport completed their transition modeling in days, not months. They're not firefighting – they're building compensation frameworks for the next decade. Early movers gain talent market advantage while others debate interpretations.

This is your moment to demonstrate organizational values through action, not just achieve compliance through reaction.

Want to get a hold of the Indian labor codes?

FAQs

What is the new Labour Code 2025 in India?

Four consolidated labour codes replacing 29 existing laws, effective November 21, 2025. They restructure wages (mandating 50% basic pay), expand social security coverage, formalize employment across sectors, and simplify compliance processes for all Indian organizations.

What are the four new Labour codes?

The Code on Wages (2019), Code on Social Security (2020), Occupational Safety, Health and Working Conditions Code (2020), and Industrial Relations Code (2020) – together reforming compensation structures, benefits, workplace safety, and employment relations.

Will there be a wage increase in 2025?

Not necessarily. While CTC might stay constant, take-home pay could decrease due to higher PF contributions on the increased fundamental salary component. Some organizations may raise CTC to maintain take-home, but it's a company-specific decision.

%20(47).avif)

.svg)

%20(54).png)

%20(53).png)

%20(51).png)